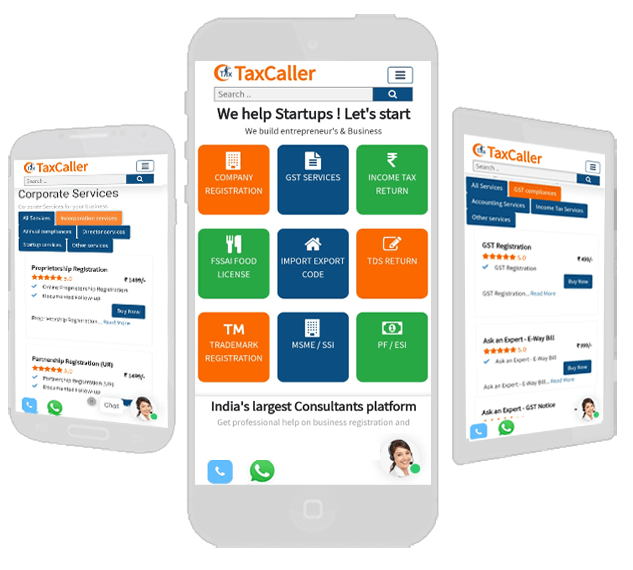

Get professional help on business registration and Compliances - Make your growing business with TaxCaller

Easily chat with TaxCaller Business Experts, find answers to thousands of FAQs, read business articles, get statutory due date alerts, start a company or register a trademark through the TaxCallar App. India's first mobile app for starting a company or registering a trademark today Comming Soon!